economy, even during the pandemic, has expanded to record levels. Manufacturing industries that dominated the economy decades ago - textiles, televisions, even automobiles to a large degree - have moved overseas, where costs are lower. The United States economy is full of innovation.

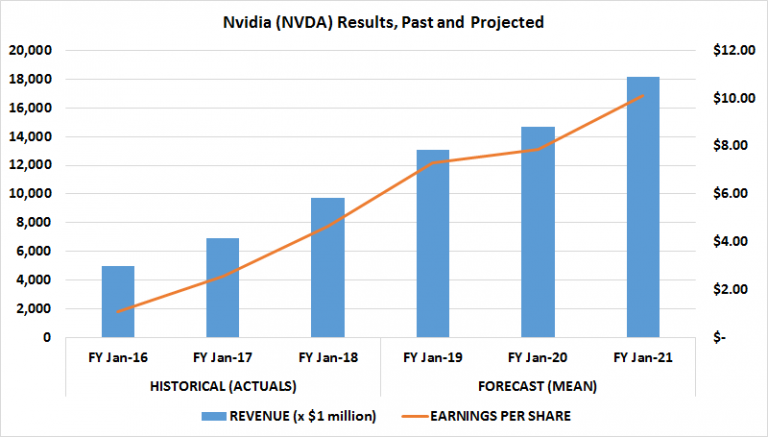

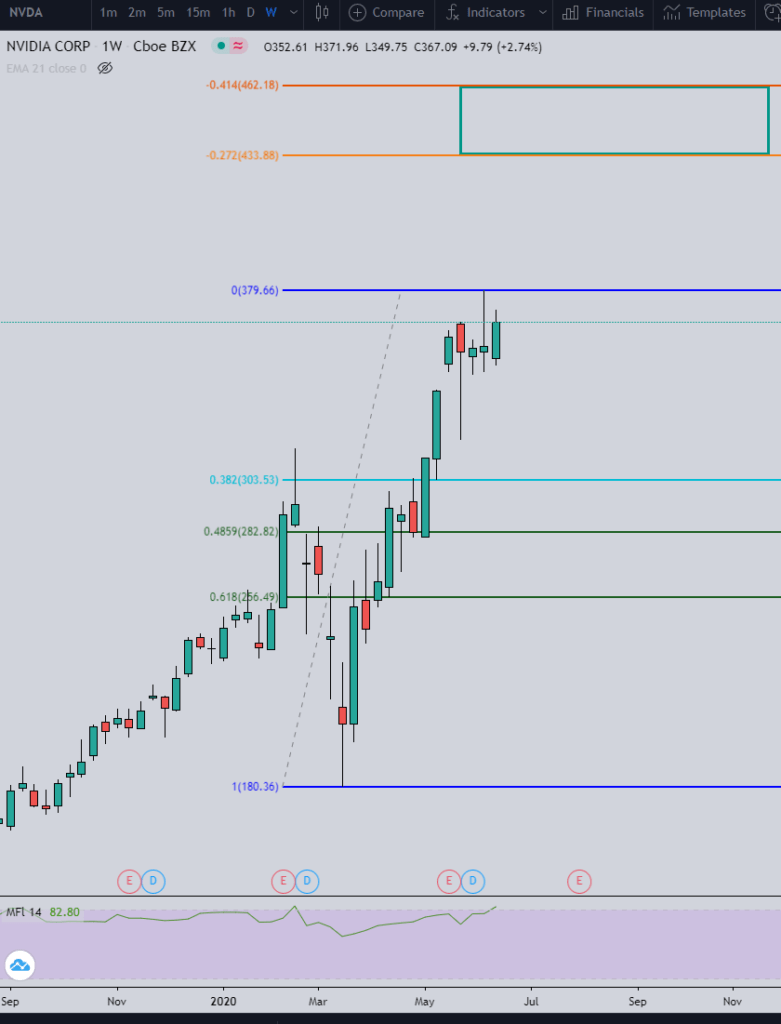

Supreme Court Justice Potter Stewart, you know it when you see it. "In reality, that's a tiny portion of their business and is made up of cards that aren't up to specification for gaming, scrap if you will.Innovation may be hard to define. "I'm sure some of you might think that Nvidia is more of an Ethereum play, because its cards are used to mine the cryptocurrency," Cramer wrote. Specifically, Jim pointed to the increasing likelihood that regulators will allow the company to buy Arm Holdings, a British company that excels in cellphones and personal computers, which will add to its already strong sales pipeline that has been driven by far more than just demand from Ethereum miners. TheStreet's Jim Cramer in his Real Money column on Tuesday noted another reason to be bullish on Nvidia: a potential acquisition that will beef up its business even more. Nvidia’s latest RTX 30 series, launched last year, has proven particularly popular with miners. Crypto miners use graphics processing units, or GPUs, to mine currencies such as Bitcoin and Ethereum. Keybanc analyst John Vinh lifted his one-year price target on Nvidia to $950 from $775, following in the footsteps of BMO Capital Markets analyst Ambrish Srivastava, who just last Thursday lifted his own price target on the chip titan to a Wall Street high of $1,000 from $975 and affirmed an outperform rating.Īnalysts have piled on the praise for Nvidia since the company’s first-quarter results, which came in better than expected amid strength in so-called hyperscale data center demand, which includes demand for its graphics cards and chips using for both gaming and crypto mining.Įven before then, analysts were touting Nvidia’s performance amid strong demand for its gaming graphics cards, which surged through the pandemic and stay-at-home orders that boosted demand for at-home entertainment like video games, compounded by the ongoing chip shortage that has boosted demand - and prices - for the chips and the cards themselves.Īt the same time, surging prices for Bitcoin, Ethereum and other cryptocurrencies this year also have fueled demand. Nvidia ( NVDA) shares gained on Tuesday after another Wall Street analyst lifted his price target to near $1,000 amid expectations of continued strong demand for video graphics cards and related semiconductors that are used for both gaming and mining cryptocurrencies.

0 kommentar(er)

0 kommentar(er)